Building materials like sand cement bricks marble granites tiles iron and steel and other construction goods are classified under various chapters of the HSN Code. Cement hsn code 2523 gst rate 28.

Gypsum Work Hsn Code Novocom Top

Natural sand of all kind whether coloured or non-coloured other than metal bearing sand fall under chapter 26 of the HSN code.

Hsn code for building material supplier in gst. Products Description HSN Codes Export and Import HSN codes. List of goods nil 1-13 schedule ii. Our Government used kota stone hsncode and gst rate in GST invoicing to meet the.

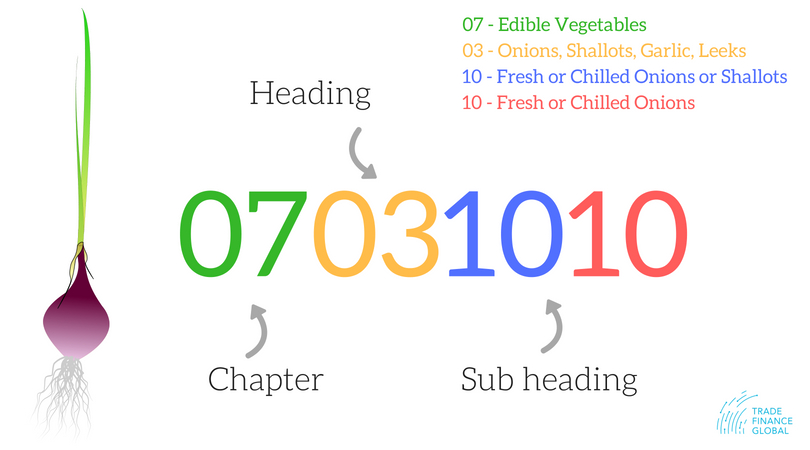

HSN Code and GST Tax rate for articles of stone plaster cement asbestos mica or similar materials under section- 13 chapter-68. Harmonized System of Nomenclature or simply HSN is a multipurpose product nomenclature designed by world customs organization. Service Code HSN Tariff Service Description 2 3 995421.

There are various GST rates of Building construction material like kota stone building material. GST Rate for Sand. General construction services of highways streets roads railways and airfield runways bridges and tunnels.

General construction services of civil engineering works. Setts curbstones and flagstones of natural stone except slate 6802. April 21 2020 GST HSN CODES.

HSN Codes for Building Materials. Long-term staffing pay rolling services. General construction services of harbours waterways dams water mains and lines irrigation and other waterworks.

If the traders trades for articles of stone plaster cement asbestos mica or similar materials then they will have to use the HSN CODE for the articles of stone plaster cement asbestos mica or similar materials in the invoice or in the GST Return for identifications of the articles. 70021000 70022010 70022090 70023100 70023200 70023900. Under GST regime it is mandatory for all the business on which HSN system is applicable to get HSN code so as to levy the proper rate of taxes on them set by the concerned authorities in India.

Temporary staffing-to-permanent placement services. Service code number 995429 Services involving Repair alterations additions replacements renovation maintenance or remodelling of the constructions covered above. List of goods 5 17-51 schedule v.

Click here to check GST rate based on HSN code. One for supply of labour and one for supply of material but are co-terminus then the same may be treated as composite supply and will shall not be eligible to claim the exemption benefit. This does not amount to any professional advice or a formal recommendation.

List of goods 12 52-79 schedule vi. M Sand 25171010 gst rate 5. Permanent placement services other than executive search.

The GST Rates HSN codes and rates are subject to periodic updates as per the law for the time being in force. Metal 25171010 gst rate 5. 13 rows Our Building materials import data and export data solutions meet your actual import and.

Glass in balls other than microspheres of heading 7018 rods or tubes unworked. HSN service number 995428 General construction services of other civil engineering works nec. Search HSN code for Building Materials in India.

General construction services of harbours waterways dams water mains and lines irrigation and other waterworks. Executive or retained personnel search services. List of goods 18 80-136 schedule vii 28 137-168.

List of goods 025 14-14 schedule iii. Rate of Tax HSN Code 9954. Here is an account of the GST rates levied on construction materials - What is the GST rate on sand.

Where supplier issues two separate bills ie. Rate and hsn code of gst index schedule and goods gst rate page no. HSN Code Product Description Import Data Export Data.

HSN Chapter Stone Material HSN Code GST Rates Monumental Building Stones68 Marble. GST rates of kota stone stone is imposed using the HSN Code. GST rate on sand is fixed at five percent.

HSN code provides standardization and global acceptance of the goods. Cullet or other waste or scrap of glass. The authors have arranged the GST Rates as well as the HSN Codes to the best of their understanding and information.

List of goods 3 15-16 schedule iv. Metal 25010010 gst rate 5. Machines and mechanical appliances having individual functions not specified or included elsewhere in this chapter.

Hence its important for those involved in construction to correctly classify goods based on HSN Code. 21 rows GST Rates HSN Codes for Cement Plaster Building Materials - Sand lime bricks or Stone inlay work Statues statuettes pedestals Carved stone products - Chapter 68. General construction services of highways streets roads railways and airfield runways bridges and tunnels.

Hsn Code List Hsn Code List With Gst Rate

Gst Rates Hsn Codes Gst Tax Rate Sac Codes In India For 2019 Fibers Textiles

Hsn Codes For Goods And Service Tax Gst In India

Hsn Code List Pdf Free Download Cleverday

Gst Hsn Code In Excel Format Free Download Cakart

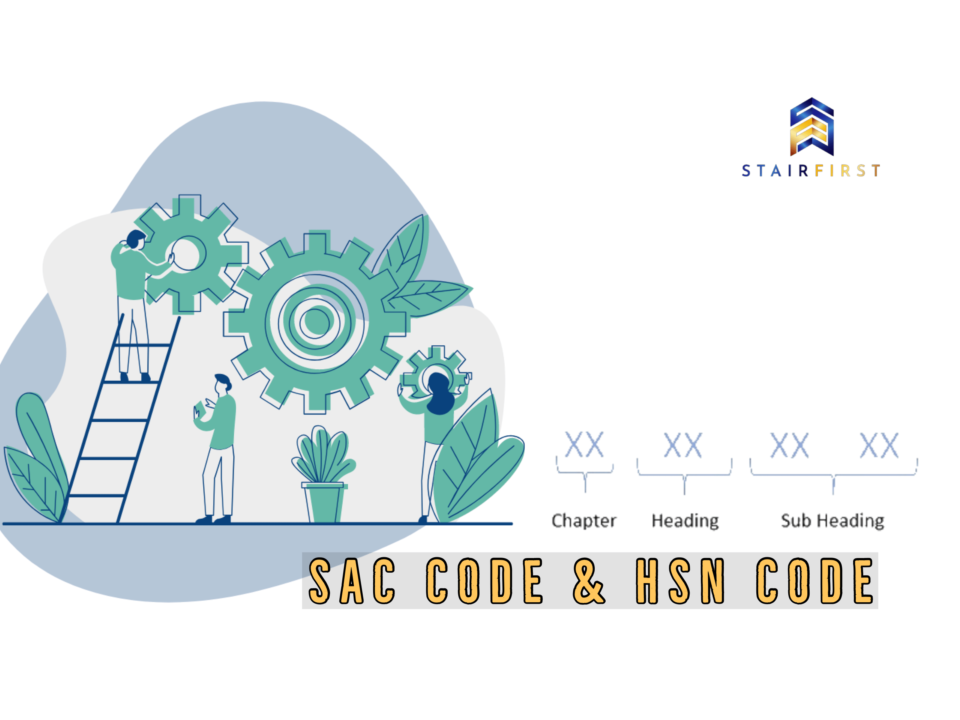

Understanding Hsn Codes Sac Under Gst 5 Questions Answered

Hsn Code List Gst Rate Finder Find Gst Rate Of All Hsn Codes Tax2win

Hsn Code Get Hsn Code For Gst In Pdf Hsn Full Form Quickbooks

Hsn Codes Upto 4 Digit Level Under Gst Legalraahi

Gst Hsn Codes Rates Excel 1 Broccoli Offal

What Is Hsn Code And Sac Code In Gst With Complete List

Kota Stone Hsn Code And Gst Rate Approved By Gst Council Naksh Stone

What Is An Hsn Code Hsn Codes Explained Tfg Guide Updated 2021

Hsn Code List Gst Rate Finder Find Gst Rate Of All Hsn Codes Tax2win

Hsn Code Gst Rate For Cement Plaster Building Materials Chapter 68 Tax2win

Komentar

Posting Komentar